How Do I Cancel My Credit Card Online (Step by Step process)

Credit cards are one of the most useful products in the world of finance. But, sometimes, cardholders find it difficult to maintain them. Also, they might feel the urge to opt for a different card altogether. In such cases, cardholders would need to close or cancel the credit card that they want to stop using.

This involves a simple process and will ensure that the cardholder doesn’t have to pay unnecessary fees and charges. Let’s take a look at the importance of closing or canceling a credit card and the process involved in it.

How to Cancel or Deactivate SBI Credit Card: Step by Step Process

- Step 1: Access your account online. Go to https://www.sbicard.com/ and click the login button at the top of the page to access your account. If you haven’t created an online account, click the link below the login button to register as a new user.

- To register as a new user, you will have to provide your card number, CVV number, and date of birth. If you don’t have your card number handy, call the SBI Card Helpline for advice at 1860-180-1290.

- Step 2: Make sure your account is active if you haven’t used your card in a while. SBI has the right to cancel credit card accounts at any time. If your account is inactive, SBI may have canceled it without your knowledge.

- Banking laws forbid banks from charging additional fees for inactivity. For this reason, SBI may close an inactive account that isn’t making the bank any money.

- Step 3: Bring your account balance to zero. SBI won’t cancel your card until your balance is paid in full. Check your account balance online to determine how much you owe. If you’ve used the card recently, be sure to check for any pending charges.

- Step 4: Switch any recurring payments to another card. If you’ve used your SBI card to make any automatic payments, contact those businesses and either cancel your automatic payments or provide a different payment method. Check the date the automatic payment is scheduled to make sure it won’t go through before you cancel your card.

- Step 5: Confirm that any payment you made has posted to your account. Before you cancel your card, log in to your online account again and confirm that the balance is zero. Look at recent transactions as well and make sure there are no pending charges that you may have overlooked.

- While you’re paying down your balance or after you’ve made your last payment, it’s a good idea to stop using your card completely. That way you’ll know there aren’t any new changes coming up.

Source: wikihow.com

Bajaj Finserv, the financial services providing arm of Bajaj Group, offers credit cards in collaboration with RBL Bank. Together, the two entities offer Bajaj Finserv RBL Bank SuperCards. The credit cards claim to offer the benefits of 4 individual credit cards.

If you are using any one of the Bajaj Finserv RBL Bank SuperCards and would like to cancel or close the card after using it for a certain period, you can use the information provided here to do it in simple steps.

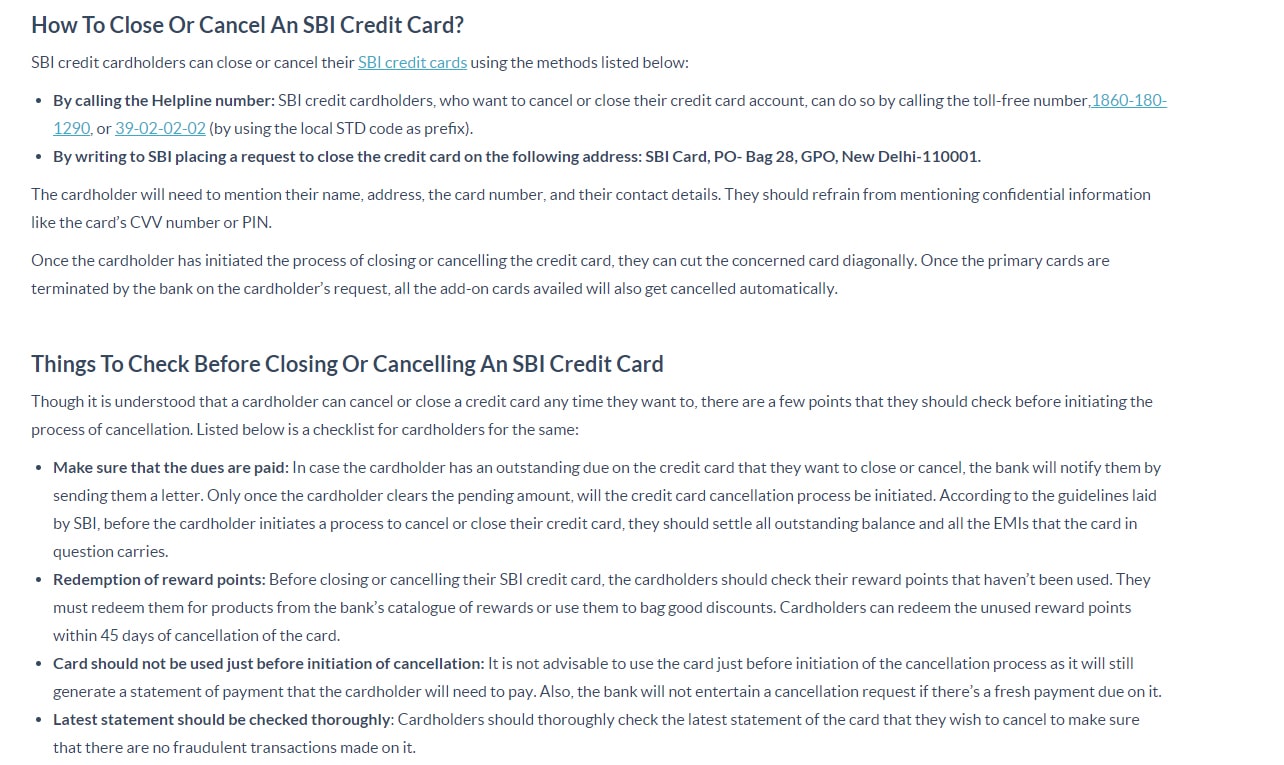

How to Cancel / Closed an SBI Credit Card

Credit: bankbazaar.com

Does A Cancelled Or Closed Credit Card Affect The Cardholder’s Cibil Score?

If a cardholder owns a number of credit cards and chooses to cancel one of them, the amount of credit available to them reduces to some extent. This leads to an increase in the credit utilization ratio which ultimately has a negative impact on the cardholder’s CIBIL score. In case, the cardholder has only one credit card that they wish to cancel or close after paying all the dues on it, they can do that without disturbing their credit score.

How To Reactivate A Closed SBI Credit Card?

Applicants can call the bank on their helpline number 1860-180-1290, or 39-02-02-02 (by using the local STD code as a prefix) or write to them at sbicorporate.services@sbicard.com. After the completion of necessary documentation and formalities, the bank will reactivate its closed or canceled SBI credit card.

Source: bankbazaar.com